We’ve all seen them—those ladder toting, opportunistic contractors who show up conveniently in your subdivision after a bad storm offering to assess your roof and siding damage with a “free estimate.” They promise that the damage they’ve found should be covered by your insurance and assure you that they’re “bonded” and ready to work. As a seasoned insurance agent in the middle of the Mountain State (aka a giant forest), I keep thinking I’ve heard it all—then I hear anther one…

“If your siding is damaged in the front where people driving up can see it, your insurance company has to replace the whole visible area.”

“If the shingles / siding you have can’t be matched anymore, your insurance company will have to spring for the whole roof / siding to be replaced.”

“If your roof is worn out from years of sun and wind damage and it’s time to replace it, your insurance may cover it for you.”

I could go on—but let’s just clarify that all 3 of the above statements are complete myths. That’s not how insurance works. If you have been led to believe otherwise, its unlikely you were speaking with an insurance professional, currently licensed in their field with years of continuing education and insurance counseling or claims experience.

To explain how insurance ACTUALLY works for your wind damage claims, I’ll go back to the beginning—of your homeowners policy that is. Most homeowners insurance policies offer two deductible selections: one for “windstorm and hail” and one for “other (covered) perils.” Some carriers will only offer a percentage of your home’s structure coverage as the wind and hail deductible option. Ex) If your house is insured for $300,000 and you have a 5% wind and hail deductible, that translates to a $15,000 deductible—yikes! I personally like to write matching deductibles for wind/hail and other perils on all homeowners insurance policies I write to keep things simple for my customer. On most of my homeowners insurance policies, you’ll find a $1000 deductible for windstorm and hail and a $1000 deductible for “other perils”. Most people are aware that there are also different levels of coverage for homeowners insurance. That’s another blog post for another day, but let’s just summarize here to say that your policy may exclude the weight of ice and snow on the roof if you have a lower level of coverage typically reserved for properties that are either very old and without updates or in need of major repairs. Let’s assume for purposes of this insurance explanation that you have the broadest coverage available on the insurance market known as special perils (H03) coverage.

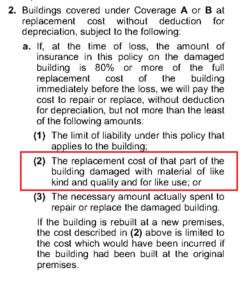

All homeowners insurance carriers I’m aware of use standardized policy forms produced by a company called Insurance Service Office, Inc. (ISO forms). You’ll recognize their formatting as part of your standardized policy packet that you receive in the mail after you first purchase your homeowners insurance. Many people would call this the “fine print” and would toss it in the trash or to the back of a drawer. In these standardized policy forms, however, is where you’ll find explanations for exactly what your policy covers, what your policy excludes, and how your insurance company will settle claims with you. Below is the excerpt from the Loss settlement section of the ISO special perils policy forms that pertains to our discussion.

This means that your insurance carrier agrees to pay for replacing only the portion of your siding or roof that was actually damaged, not to pay for the siding to be replaced on the entire home or the shingles to be replaced on the entire roof in the event of a partial claim. Notice also that the insurance company promises to pay for LIKE kind and quality, not EXACT matches. If your roof or siding is 20 years old, the matching materials could be discontinued. The insurance company will pay for the portion that was damaged, but if an exact match is important to you and it is not available in the store, you would need to pay the difference yourself.

I know what you’re thinking— “Insurance is a rip off!” “I didn’t have mismatched siding before my claim, the carrier needs to make me whole!” “That should be illegal!” Yes… I have heard all these things before, and I really do empathize. Don’t shoot the messenger. It’s my job to show you how your policy works so that you can be better prepared to make educated purchasing decisions and have an informed claims process with the knowledge to advocate for yourself.

Insurance has other restrictions I will cover in future blog posts… but its vital that we consider why these coverage limitations are in place. Can you imagine the cost of an insurance policy if it covered everything? If every time a few pieces of siding or roofing were damaged, the policy (currently costing an average of $700-1500 a year for a 200k house’s replacement cost) paid tens of thousands of dollars to replace the entire roof, siding, or bricks of the home just so it would be guaranteed to match? No one would be able to afford homeowners insurance at that point, and this is just one example of a coverage restriction.

To find out more about your insurance coverage and how it works, be sure to follow us on Facebook @ellisinsuranceagency1981 and TikTok @ellis.insurance. Send us your questions for more topics you want us to cover to hello@insurewithellis.com.